Embracing the Future: 2023 Bluetooth® Market Update Summary

- Packetcraft

- Jul 25, 2023

- 5 min read

Data indicates the diverse applications and growth potential of Bluetooth® technology in various sectors, ranging from healthcare and consumer electronics to smart homes and industrial environments. Bluetooth® technology has immense potential in reshaping industries by revolutionizing the way organizations operate and connect. At Packetcraft, we recognize these trends and leverage our expertise to develop solutions that push the boundaries of what's possible, helping our customers stay ahead in a fast-paced, interconnected world.

In the market report for 2023, Bluetooth Sig released data-driven insights for the future of Bluetooth. Below are stand-out items we want to highlight in context of the solutions Packetcraft provides.

Bluetooth Market Forecast

In general, the forecasts indicate a steady incline in the total number of Bluetooth-enabled devices shipped, with analysts anticipating higher growth over the later half of the five-year forecast. By 2027, 7.6 billion Bluetooth-enabled devices will be shipping annually.

Dual-Mode Operation Becoming Standard. Single-Mode on the Horizon.

Bluetooth Classic and Bluetooth Low Energy (LE) radios are included in all traditional platform devices, and dual-mode operation is becoming standard in additional platform devices. Single-mode Bluetooth® LE device shipments are expected to grow, driven by strong growth in peripheral devices, with 97 percent of all Bluetooth devices including Bluetooth LE by 2027. Bluetooth peripheral device shipments are set to double platform device shipments in 2023.

The Bluetooth Spec is Constantly Developing.

The Bluetooth SIG member community is actively working on expanding the capabilities of Bluetooth® technology through various specification projects, with over 50 active projects in process.

Recently Completed Projects: Recently completed projects include LE Audio, which enhances Bluetooth audio performance and introduces support for hearing aids, and Periodic Advertising with Responses (PAwR), a new logical transport for Bluetooth Low Energy (LE) that benefits the electronic shelf label (ESL) market.

Upcoming projects include High-Accuracy Distance Measurement, enabling precise distance measurement between Bluetooth devices, and Higher Data Throughput, addressing the need for faster data transfer rates.

Another upcoming project focuses on operating Bluetooth LE in higher frequency bands, including the 6 GHz frequency band, to support performance enhancements and meet future needs.

Full Stack Solutions

Bluetooth® technology offers full-stack solutions in various areas to meet the expanding needs of wireless connectivity, including audio streaming, data transfer, location services, and device networks.

Audio Streaming

Audio streaming has been a key use case for Bluetooth, revolutionizing the way we consume media and experience audio. It encompasses wireless headsets, speakers, and in-car systems.

Despite post-pandemic challenges, annual Bluetooth audio streaming device shipments are expected to grow by 1.35x from 2023 to 2027.

Earbuds are driving growth in the audio streaming market, with 56% of all Bluetooth wireless headsets shipped in 2023 expected to be earbuds.

Bluetooth technology is widely adopted in speakers, with 98% of all speakers expected to include Bluetooth technology in 2023.

LE Audio and Hearing Aids

LE Audio is expected to standardize Bluetooth audio implementation in hearing aids, providing better support for the estimated 2.5 billion people with hearing loss by 2050. Annual shipments of Bluetooth-enabled hearing devices are projected to increase by 5.7x over the next five years.

The introduction of over-the-counter (OTC) Bluetooth-enabled hearing aids in the U.S. has created a new market segment, allowing direct purchase without a medical exam or prescription. Annual shipments of Bluetooth-enabled OTC hearing devices are expected to increase by 9.5x by 2027.

Wearables

In the data transfer domain, Bluetooth technology powers various devices such as sports and fitness trackers, PC peripherals, and health and wellness monitors.

The demand for wearables, including smartwatches and fitness trackers, is driven by increased health awareness, post-pandemic health services, and technological advancements in health sensors. Annual shipments of Bluetooth smartwatches are expected to increase from 143 million in 2023 to 290 million in 2027.

Bluetooth wearables, including fitness and wellness trackers, are set to experience strong growth, with an estimated 635 million wearables shipping in 2027.

AR/VR

Bluetooth AR/VR devices, such as VR headsets and AR smart glasses, are expected to see significant growth. Shipments of Bluetooth VR headsets will increase by 6x over the next five years, while Bluetooth AR smart glasses will grow by 15x from 2023 to 2027.

Location Services

Bluetooth® technology is widely used for high-accuracy indoor location services, enabling device positioning and flexible indoor positioning solutions. Key use cases include asset tracking, indoor navigation, digital key, and personal item finding and shipments are projected to experience significant growth, with a 2.46x increase from 2023 to 2027.

Location Services - Drivers for Today:

Commercial real-time location systems (RTLS) solutions are poised for rapid acceleration, driven by new regulatory safety requirements, compliance procedures, and sustainable operation measures.

Bluetooth® asset tracking solutions and tags are major drivers behind the continued growth of Bluetooth Location Services.

Personal item finding solutions, such as Bluetooth® tags, are experiencing increased demand, leading to a 2x growth in annual shipments by 2027.

Bluetooth® technology is playing a crucial role in automotive access control, with key fobs and accessories driving demand.

Location Services - Drivers for Tomorrow:

Bluetooth® technology will introduce high-accuracy distance measurement (HADM) to provide greater precision in item finding solutions and enhance the performance of real-time locating systems.

The Ambient IoT, enabled by low-cost Bluetooth® tags, will disrupt market forecasts and significantly improve supply chains across various verticals.

Device Networks + ESL labeling

Bluetooth® Device Network solutions connect tens, hundreds, or thousands of devices within a network, offering reliable and secure connectivity. Key use cases include networked lighting control, monitoring systems, and electronic shelf labels. Bluetooth® Device Network device shipments are expected to grow by 2.63x from 2023 to 2027.

Device Networks - Drivers for Today:

Bluetooth® technology dominates as the radio of choice for commissioning in smart home devices and is expanding its role in the home IoT market.

Smart appliances, such as air purifiers, conditioners, and countertop appliances, are witnessing significant growth in Bluetooth® shipments.

Device Networks - Drivers for Tomorrow:

Bluetooth® networked lighting control is experiencing mainstream traction due to the adoption of LEDs, energy efficiency demands, and enhanced occupant experiences.

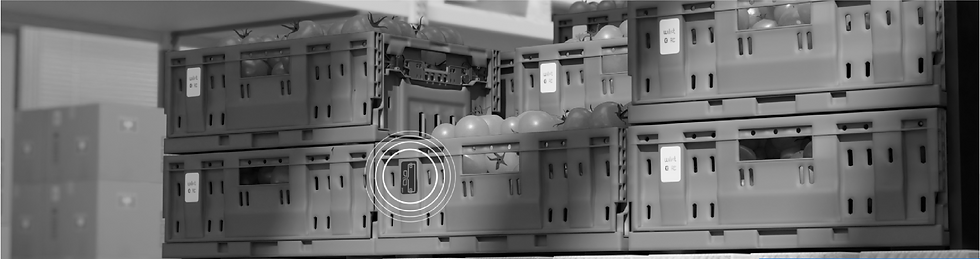

Electronic shelf labels are emerging as a high-volume market, providing accurate pricing, real-time promotions, and a cohesive omnichannel experience for retailers.

Bluetooth® condition monitoring solutions are driving greater sensorization in industrial settings, enabling preventive and predictive maintenance.

To read the rest of the comprehensive market report from SIG go here.

SUMMARY

The 2023 Bluetooth® Market Update highlights the immense potential of wireless connectivity in shaping industries and driving innovation. With our commitment to excellence, constant innovation, and customer-centric approach, Packetcraft continues to lead the way in developing cutting-edge Bluetooth® solutions that empower businesses to thrive in the digital age. As we embrace the future, we invite you to join us on this exciting journey of redefining wireless connectivity and unlocking new possibilities for your organization.

Comentarios